Cart

0

Product

Products

(empty)

No products

Free shipping!

Shipping

0,00 €

Packing fee

0,00 €

Total

Product successfully added to your shopping cart

Quantity

There are %d items in your cart. There is 1 item in your cart.

Categories

- Albums (2085)

- Antique (before 1850) old books (before 1941) (584)

- Art and culture (5354)

- Audiobooks, compact discs (CD) (121)

- Autographed books (250)

- Board games (19)

- Books for school (4705)

-

Books in foreign languages

(8525)

- Books in Altai (4)

- Books in Azerbaijani (47)

- Books in Belarusian (46)

- Books in Bulgarian (2)

- Books in Dutch (2)

- Books in English (6698)

- Books in Estonian (10)

- Books in Finnish (7)

- Books in French (43)

- Books in Georgian (37)

- Books in Greek (2)

- Books in Hungarian (6)

- Books in Italian (12)

- Books in Japanese (7)

- Books in Karelian (3)

- Books in Kyrgyz language (6)

- Books in Latvian (46)

- Books in Lithuanian (7)

- Books in Norwegian (4)

- Books in Polish (14)

- Books in Portuguese (2)

- Books in Slovak (2)

- Books in Spanish (17)

- Books in Swedish (3)

- Books in Tajik (34)

- Books in the Adyghe language (3)

- Books in the Balkar language (8)

- Books in the Bashkir language (73)

- Books in the Buryat language (5)

- Books in the Kalmyk language (8)

- Books in the Karachai language (1)

- Books in the Komi language (5)

- Books in the languages of the peoples of the Caucasus (7)

- Books in the Mari language (17)

- Books in the Mokshan language (1)

- Books in the Mordovian language (3)

- Books in the Nogai language (1)

- Books in the Tatar language (101)

- Books in the Udmurt language (10)

- Books in the Yakut (Sakha) language (27)

- Books in the Yarzyan language (2)

- Books in Ukrainian (973)

- Books in Uzbek (9)

- Chuvash language books (29)

- Kazakh language books (8)

- Business. Economy (1628)

- Calendars (41)

-

Children's Literature

(10376)

- Books for parents (356)

-

Children's creativity and leisure

(905)

- Children's games. Experiments and experiments (15)

- Coloring pages (12)

- Crafts, cooking for children (6)

- Drawing for children (11)

- Make with your own hands (29)

- Modeling, application (7)

- Organization of children's parties (2)

- Origami, paper craft (5)

- Puzzles, crosswords for kids (7)

- Questionnaires, diaries, albums (1)

-

Educational and educational literature for children

(1735)

- Attention. Imagination. Memory (27)

- Basic security (4)

- Creative development (46)

- Foreign languages (102)

- General development. Manuals, reference books (83)

- General preparation for school (45)

- Introduction to the outside world (69)

- Logic. Thinking (31)

- Math and counting (43)

- Teaching reading and writing (91)

-

Educational literature for children

(769)

- Biographies for children (37)

- Books for boys (21)

- Books for girls (19)

- Culture, art, religion (48)

- Encyclopedias, reference books and other educational literature for children (181)

- History for children (86)

- Nature and the environment (242)

- Psychology. Etiquette (12)

- Science, technology, transport (54)

-

Fiction for children

(4345)

- Books for kids (111)

- Books on cartoons and films. Comics (82)

- Detectives and adventures for children (194)

- Foreign prose for children (307)

- Myths. Legends. Historical prose for children (69)

- Poetry for children (147)

- Russian prose for children (414)

- Science Fiction, Fantasy and Horror for Kids (118)

- Tales (504)

- Tales and stories about animals (144)

- Soviet children's books (901)

- Toy books (40)

- Collected works. Multivolume editions (3696)

- collection sets (53)

- Comics (53)

- Cookery (1381)

- Dictionaries. Phrasebooks (1322)

- Electronic books (10)

- Encyclopedia (1021)

- Engravings (7)

- Feng Shui (112)

- Fiction (84515)

- German and Germany (35896)

- gramophone records, vinyl (131)

- Guides (2056)

- Healthy lifestyle. Healthy eating. Fitness (1811)

- History (9795)

-

House. Life. Leisure.

(7699)

- Dom. Life (3178)

- Erotic books, books about sex, kamasutra (193)

- Hobby. Leisure (1657)

- Reference Literature (2168)

-

Sport

(960)

- Aerobics. Fitness. Yoga. Dancing (31)

- Board games (158)

- Combat and martial arts (82)

- Extreme sports (12)

- Gymnastics. Light and weightlifting (8)

- Olympic Games (13)

- Other sports (51)

- Physical culture and sport (72)

- Self-defense. Survival (20)

- Sport games (23)

- Tourism (85)

- Water sports (28)

- Winter sports (18)

- Kits (different books) (139)

- Kits (magazines) (60)

-

Magazines and newspapers

(2550)

- Architecture, interior (9)

- Astrology, esotericism (35)

- Bills (233)

- Calendars 2020 (1)

- Calendars 2021 (3)

- Cars, hunting, fishing (14)

- Celebrities, ZhZL (33)

- Children's magazines (12)

- Computer, technology (4)

- Cooking and Recipes (25)

- Crosswords, Scanwords (2)

- Editions with TV program (133)

- Entertainment magazines (7)

- Fashion, style, beauty (17)

- History (111)

- Hobbies, interests (104)

- Home, family, leisure (74)

- House, garden, vegetable garden (34)

- Literature, theatre, music (235)

- Magazines for men (210)

- Magazines for parents (2)

- Magazines for women (108)

- Medicine, health (153)

- Religion (10)

- Russian press abroad (480)

- Science, technology, fantasy (168)

- Sewing, knitting, needlework (8)

- Society, politics (636)

- Special Editions (57)

- Travel, countries (14)

- Maps, atlases (663)

- Military business. Weapons. Special services (4062)

- Miniature books (149)

- Music. Sheet music (1043)

- Postage stamps (92)

- Postcards (191)

- Posters (37)

-

Professional, educational literature

(24714)

-

Applied sciences. Technique

(2522)

- Agriculture. Veterinary medicine (40)

- Architecture (359)

- Chemical industry (104)

- Construction (445)

- Design (136)

- Energy (68)

- Engineering. Instrumentation (184)

- Food industry (19)

- Jewellery (22)

- Life safety (46)

- Light industry (39)

- Metallurgy (28)

- Mining (83)

- Nanotechnologies (5)

- Oil and gas industry (53)

- Other industries (101)

- Polygraphy (8)

- Radio engineering. Electronics. Communication (263)

- Technical Sciences (330)

- Technology of production (100)

- Timber and wood chemical industry (13)

- Transport (183)

-

Computer Literature

(486)

- Administration. Information security (5)

- Computer for … (16)

- Computer networks. Internet (23)

- Databases (8)

- Design systems (CAD/CAM) (1)

- General questions (41)

- Graphics, design, multimedia, games (27)

- Hardware (4)

- Informatics (27)

- MS Office. Microsoft office programs (11)

- Operating systems (12)

- PC work for beginners (18)

- Programming languages and environments (37)

- Humanities (8851)

-

Legal Literature

(1004)

- Civil law (54)

- Civil procedural law. Judiciary (8)

- Comments (12)

- Constitutional law. Administrative law (30)

- Criminal law (40)

- Criminology. Criminalistics (37)

- Customs law (8)

- Financial law (11)

- International law (34)

- Labor law. Social security law (9)

- Land law. Environmental law (3)

- Law enforcement agencies (23)

- Law in general. History and theory of state and law (30)

- Other branches of law (23)

- Regulatory acts. Reference literature (19)

- Right in everyday life (17)

- Textbooks and teaching aids (43)

- Workshops and practical aids (6)

-

Medicine and Health

(2417)

- Applied Medicine (42)

- Clinical Medicine. Internal Medicine (21)

- Cosmetology (20)

- Fundamentals of Medicine. Healthcare System (26)

- General pathology. General therapy (19)

- Narcology (12)

- Nervous system (29)

- Other branches of medicine (89)

- Pediatrics (52)

- Pharmacology. Toxicology (21)

- Popular and alternative medicine (1113)

- Psychiatry. Neuropathology. Sexopathology (71)

- Surgery (18)

- Monographs (1109)

- Natural sciences. Mathematics (2228)

- Social Sciences (5600)

-

Applied sciences. Technique

(2522)

- Religion. Esotericism (6360)

- Russian Abroad (books published abroad) (2599)

- Russian language (773)

- Russian language for children (Textbooks) (154)

- Soviet books until 1992 (12967)

- Yoga Books (159)

- Show All

More info

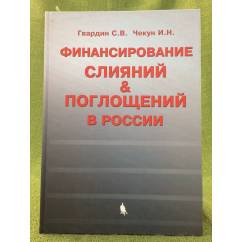

The main mechanisms for attracting financing are given - issues of shares, bonds, bills, lending, issues of IPO, private placement of shares, syndicated lending, leasing are considered. The institutions involved in the financing process are described. The features and trends of M&A processes in Russia, as well as the sources of their financing are considered. The mechanisms of external and internal buyouts of the company are analyzed. A feature of the book is the analysis of all processes based on Russian reality. Each section is accompanied by examples from Russian and foreign practice. The book will be of interest to company owners considering mergers and acquisitions as a possible business development strategy, teachers, graduate students, students, specialists in the field of mergers and acquisitions, investments, as well as anyone interested in mergers and acquisitions and financing long-term investments.

Data sheet

| Publisher | Бином. Москва. 2006 |

| Bookbinding | твердый переплет, 195 стр. |

All author\'s books:

Seller Info/Map |

Seller type: Company (business)

Подробнее

Book market

ISIA Media Verlag UG (L)

Volbedingstr. 2 A2-03

Leipzig, 04357

Germany

03416870612

Volbedingstr. 2 A2-03

Leipzig, 04357

Germany

03416870612